ÖZET (TR)

Türkiye’ye giriş bütçelerinde çoğu model, “informal” kanal ve fatura dışı teşvikleri eksik fiyatlıyor. Saha görüşmeleri + rekabet haritalamasıyla bir Fortune 500’ün ~€2M’luk RTM sapmasını önledik. Yazıda yöntemi, ölçüm çerçevesini ve hibrit ağ tasarımını anlatıyoruz.

How informal channel dynamics quietly distort distribution margins — and how to fix them

Standfirst (deck): Most Turkey-entry budgets treat informal channel dynamics as rounding error. They aren’t. They are the signal that determines your real route-to-market (RTM) cost.

The problem in one line

Most Turkey-entry budgets misprice distribution margins because they treat informal channel dynamics as noise. They aren’t. They are the signal that sets your real RTM cost.

What companies typically miss

- Off-invoice incentives: shelf/placement fees, period-end bonuses, returns, listing fees.

- Cash/early-payment discounts that stack by region and tier.

- Regional sub-distributors beyond metro areas that add hidden layers.

- Grey flows/transit effects that blur the “official” price ladder.

On paper, you plan for X% distributor margin. In the field, these layers can push the actual cost +5–9 points above plan — enough to distort pricing, working capital, and launch ROI.

The case (anonymized)

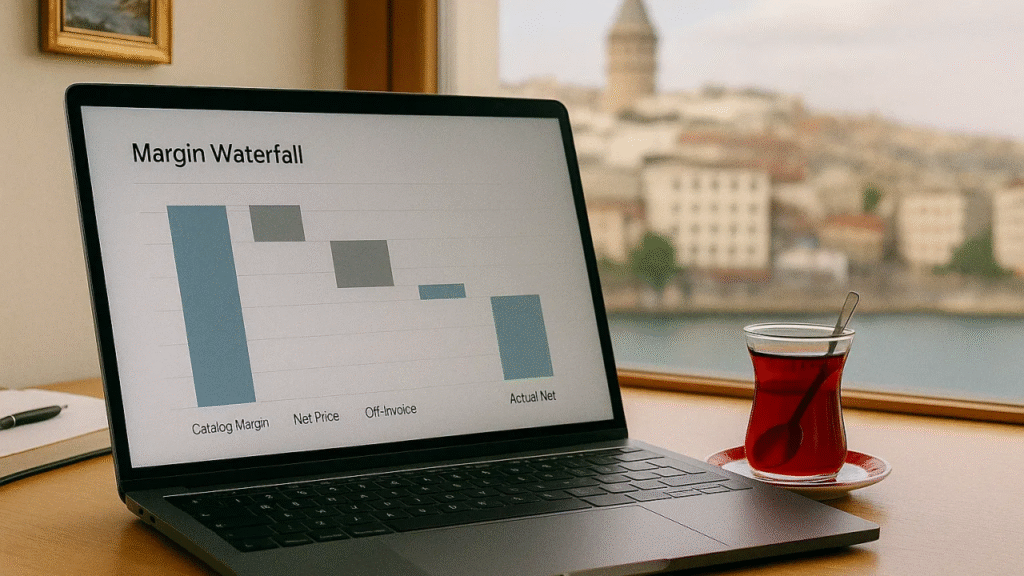

A Fortune 500 planned a two-tier national distributor network for Turkey. Their budget priced margins using catalog/benchmark values. Our job: stress-test the margin waterfall before contracts.

What we did

- Field interviews across the chain (distributors, sub-distributors, retail buyers, independents).

- Competitive mapping (SKU density by channel/region, promo calendars, logistics constraints).

- Margin waterfall (List → Net → Off-invoice → Actual net, by region/tier).

- RTM scenarios (single national, two-tier national, and hybrid direct + regional).

The overlooked datapoint The model used a single national margin. But in regions reliant on sub-distributor chains, off-invoice + early-payment stacks lifted the real take by >6 points. Aggregated to the planned volumes, that meant a ~€2M RTM overrun in year one.

The fix: redesign the route, reset the incentives

- Hybrid RTM: direct service in metro clusters; selective regional sub-distributors elsewhere.

- Incentive architecture reset: off-invoice items tied to transparent KPI/SLA (SKU penetration, returns, on-time payment).

- Price point re-calibration based on the actual margin waterfall, not the catalog one.

- Data cadence: monthly stock–sellout reconciliation and promo shadowing by region.

Outcome Launch volumes preserved; the ~€2M overrun removed. First-year gross margin +3.2 pts vs. the original plan (client data, anonymized).

A practical 3-week audit you can run before launch

- Week 1: 20–30 structured interviews + quick competitive map (regions, tiers, promo tempo).

- Week 2: Margin waterfall by region/tier; simulate 2–3 RTM architectures.

- Week 3: Final RTM design (hybrid where needed), KPI/SLA pack, and negotiation brief with hard numbers.

Why BKP

- Field-first evidence: access to the right stakeholders, structured interviews, targeted surveys.

- Competitor intelligence: ongoing mapping of price, incentives, and distribution structure.

- Enterprise-grade: proven with Fortune Global 500s and large industrials across Turkey and the region.

Planning a Turkey entry?

Start with a Route-to-Market Audit. In 3 weeks, we’ll surface your actual margin waterfall, de-risk your network design, and protect your launch economics.

Contact: info@bkpconsulting.com • +90 (212) 219 70 66

#RouteToMarket #Distribution #TurkeyMarketEntry #ChannelStrategy #Pricing #CompetitiveIntelligence #B2B #BKPResearch